11/10/2022

Last month, the European Securities and Markets Authority (ESMA) published its final guidelines on the sustainability-related amendments to MiFID II which came into force in August.

With the asset management industry grappling with the consequences of inflation and rising interest rates, you’d be forgiven for letting the snappily titled, Final Report: Guidelines on certain aspects of the MiFID II suitability requirements pass you by!

The new amendments require European firms to:

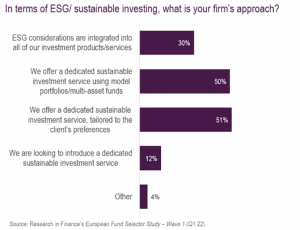

Fund selectors and advisers on the Continent have known about these new requirements for a while and when we surveyed them on their firm’s sustainable investing approach at the start of this year, many reported having a dedicated sustainable investment service in place already (as illustrated by the chart below). However, there were gaps, most notably acknowledged by Italian professionals.

We (and our clients) are eager to assess progress a year on. We also feel it is important that asset managers understand the extent to which sustainable offerings are becoming the default for European distributors, with Article 8 fund status potentially being the minimum requirement for gaining entry.

In 2022, Research in Finance launched a European study targeting fund selectors in the major asset management markets. The upcoming second European Fund Selector Study (EuroFSS) wave proffers a bigger sample size and the addition of institutional investors to the target audience. Join wave 2 and take a deep dive into how Fund Selectors, Advisers and Institutional investors are meeting demands for sustainable investing and whether your business is on track to remain competitive in this challenging and innovative space.

For more information on EuroFSS please get in touch with Mick Hrabe or Richard Ley. You can also call us on +44 (20) 7104 2235.