21/07/2020

There is no doubt that the Covid-19 crisis has brought social factors such as working conditions and public health under greater scrutiny in the investment landscape. And this is not only the case in the asset management industry, but in communities and economies across the world.

So as people and companies continue to adapt to new ways of working and the search for a vaccine goes on, investment managers are looking at a world with new risks to consider when comprising portfolios for investors.

Sound investment strategy has always been about the balance of risk and return. Among both retail and institutional investors, the appetite for return at the expense of the risk on the investment table is at the core of anybody’s decision-making. That’s the bread and butter.

Of course, there are also a multitude of factors which can impact that balance and investor thinking more broadly – liquidity, historical performance, investment time horizons and experience – to name but a few.

But perhaps considerations around ESG (Environmental, Social and Governance) factors are increasingly no longer being seen as external factors to investor sentiment and thinking, but much more intrinsic to the dynamic of risk and return.

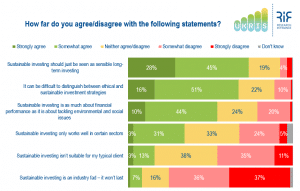

In our UK Responsible Investing Study (UKRIS), conducted at the end of 2019 / start of 2020, there was already an indication that investors were perceiving responsible and sustainable investing as an important consideration when making decisions. 73% of retail intermediaries (IAs and DFMs) surveyed agree that “sustainable investing should just be seen as sensible long-term investing”, as shown in the chart above. This proportion increases to 80% among the institutional investor audience we surveyed.

Climate change had already been at the forefront of many investors’ minds throughout 2019, particularly on the institutional side, with the Department for Work and Pensions regulation, backed by UK Sustainable Investment and Finance Association (UKSIF), specifically requiring pension schemes to consider ESG factors.

But with Covid-19 highlighting the importance of the ‘S’ under the ESG umbrella, such as working conditions, workers’ rights and healthcare, responsible investing looks set to be placed ever closer to the core of investment strategy.

‘Risk’ can be defined as a situation involving exposure to danger or loss. It therefore makes sense to consider climate change and the exposure of your investments to the effects of climate change when deciding investment strategy. Exposure to climate change through investments is a risk.

And as we take the learnings from the Covid-19 crisis, and look to build a better future, it also makes sense to look at the companies you have invested in, either as an individual or a pension scheme, that they have sound policies on working rights and working conditions of their employees. It makes sense to look at whether companies have proper accountancy standards and an independent board when assessing their governance. These are all risks, and therefore should be taken into account when making long-term investment decisions.

Responsible investing can be viewed as a very broad and sometimes vague term. But if you look at the specific ESG factors involved and the risk within the investment decisions made, responsible investing could, and should, just simply be seen as sensible investing.

The UKRIS quantitative research surveyed 211 retail intermediaries and 155 institutional investors, providing a wealth of information in responsible investing. The retail study included a mix of DFMs and IAs, while the institutional study gathered views from consultants, professional trustees, scheme managers, pension CIOs and trustees. Fieldwork was conducted in Q4 2019 for the retail component and in Q1 2020 for the institutional component.

If you would like to know more about these influential studies and what is on offer, please contact Richard Ley or Jack Dominy.