11/05/2022

Despite the rise in passive investing, actively managed funds still dominate across Europe.

The appetite for passive investing has grown over the past decade, and with the rise of robo-advice firms and advancements in automation, predictions suggest this is set to rise.

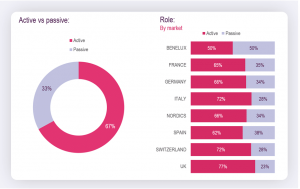

Still, data from Research in Finance’s European Fund Selector Study (EuroFSS) shows that active funds still dominate overall, with around two thirds of firm assets in active strategies. This finding is based on responses from nearly 650 fund selectors across eight major markets.

A closer look at the data reveals the Benelux region is an exception, as the proportion of active and passively-managed assets are equal. This contrasts to the UK, where under a quarter of assets sit in passive funds, despite the allure of lower fees and potentially greater tax efficiency. This perhaps reflects a persisting reticence to recommend ETFs, while these have been embraced by some of the major banking groups on the Continent for simplified advice solutions.

Rising inflation and interest rates will nudge fund selectors towards the more defensive active managers and asset classes. However, a proliferation of passive products in recent years means there are plenty of inflation-hedging options (think commodities trackers). The second wave of EuroFSS in Q3 this year will give a view of the direction of travel.

If you would like to know more about the European Fund Selector Study, please contact Toby Finden-Crofts, Richard Ley or Mick Hrabe. Options exist to purchase this inaugural wave as well as the opportunity to become a full syndicate member for the next wave. This provides access to a range of brand performance metrics, including use, consideration, positive associations and client service ratings.