28/02/2023

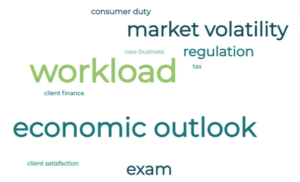

It is no secret that the global economy is facing huge challenges, but how is the industry coping with these difficulties? In a recent survey conducted by Research in Finance, we asked 605 Wealth Managers, IFAs, Paraplanners and Administrators what was keeping them up at night. The answers were unsurprisingly similar across the board. In the main, the industry is focused on current market volatility, the causes of and resulting performance.

Wealth Managers

Wealth Managers in particular are concerned about the economic outlook and market volatility because clearly these factors have a significant impact on the performance of the investments they manage.

There are several factors contributing to the current volatility in the stock markets. These include:

And finally, but in no means least, there are several geopolitical threats creating great cause for concern:

Independent Financial Advisors (IFAs)

IFAs, whilst also worrying about marketing volatility and the economic outlook, seem to be more concerned with the regulatory landscape (with Consumer Duty mentioned specifically several times) and their workload.

While regulation is important for protecting consumers and maintaining a level playing field in the financial services industry, it can also pose challenges for IFAs who must comply with these requirements while running a successful business. Regulations creates additional costs and administrative burdens for IFAs. For example, they may need to invest in additional training, obtain certain certifications, and maintain detailed records of client interactions and investment recommendations. Additionally, regulatory compliance can also expose IFAs to legal and reputational risks if they fail to meet their obligations.

Specifically, the advent of UK Consumer Duty is very likely to lead an increase in their administrative burden and costs. This, in turn, could make it more difficult and expensive for IFAs to provide their services to clients. There are also concerns that the new duty could lead to greater scrutiny of financial advisors, potentially leading to increased liability and litigation risk if clients feel that they have not received appropriate advice.

Paraplanners and Administrators

Paraplanners and Administrators, again whilst of course wary of regulation, the economic outlook and any ensuing impact, are more focused on their workload due to the nature of their business, in particular exam preparation.

They are expected to take several exams depending on their jurisdiction, area of expertise and the requirements of their employer or regulator, all requiring a large amount of study. Added to this burden is their typically heavy workload, owing to the complexity of Financial Planning, which involves a variety of complex tasks such as analysing data, preparing financial reports, creating investment strategies, and providing recommendations to clients. They are also responsible for ensuring that all documentation and reports comply with regulatory requirements. This can be a time-consuming task that requires attention to detail and a strong understanding of the regulatory landscape.

They must also manage administrative tasks such as scheduling appointments, managing client databases, and preparing client meeting agendas. These tasks may seem minor, but they can add up and take a significant amount of time.

Paraplanners also work closely with financial advisors, providing support in areas such as investment research, portfolio analysis, and financial modelling. This requires a significant amount of coordination and communication, as well as the ability to work under tight deadlines.

Historically, financial planning firms have tended to keep their administrators in the back-office function. Their main tasks included new business processing, collation of letters of authority and liaising with product providers. Now, with the delivery of a high-quality financial planning service a key focus, the role of the administrator has taken on new importance. They are taking on some of the pressures previously attributed to paraplanners and as illustrated by our survey results, are feeling the burden.

Last but by no means least, with an aging population and a growing need for financial planning services, there is an increased demand for financial planning. This means that paraplanners and administrators may be working with more clients, taking on more responsibilities, and facing greater pressure to meet deadlines.

If you would like further information on the types of research and insight that we can provide to help you drive your business forward, please get in touch and we will be delighted to help.